At Apex Law Office LLP, we recognize the complex landscape IT exporters face when claiming GST refunds. With the Indian Goods and Services Tax (GST) regime offering multiple refund mechanisms, understanding eligibility, documentation, and proper filing is essential. This article provides a detailed guide on GST refund mechanisms for IT exporters, highlighting how expert legal services can optimize your refund claims efficiently and compliantly.

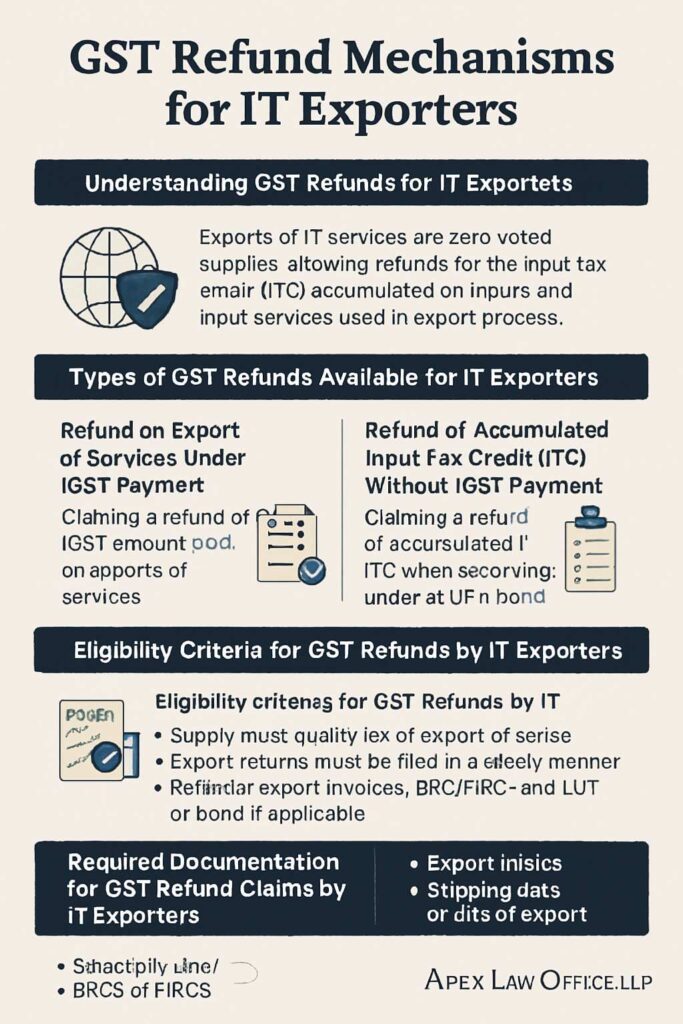

Understanding GST Refunds for IT Exporters

The GST law considers exports of services, including IT services, as zero-rated supplies. This classification means exporters pay no GST on their outward supplies but can claim refunds for the input tax credit (ITC) accumulated on inputs and input services used in the export process. Consequently, IT exporters participating in the evolving global services market must leverage the GST refund system to maintain robust cash flow and competitive pricing.

Legal professionals at Apex Law Office LLP assist clients by decoding the GST refund provisions applicable to IT exports. Furthermore, exporters can claim refunds either by paying Integrated GST (IGST) on exports or through the LUT (Letter of Undertaking) or Bond mechanism without paying IGST but claiming accumulated ITC refunds. Timely and properly filed refund claims allow exporters to avoid liquidity crises caused by prolonged tax credit blockages.

Types of GST Refunds Available for IT Exporters

Refund on Export of Services Under IGST Payment

If an IT exporter pays IGST on the exported services, they can claim a refund of the IGST amount paid. This refund is generally processed automatically once the shipping bills and GST returns are linked and verified by customs and tax authorities. Apex Law Office LLP advises clients on meticulous record-keeping and compliance to benefit from this route.

Refund of Accumulated Input Tax Credit (ITC) Without IGST Payment

When exporting under a LUT or Bond without paying IGST, exporters accumulate ITC that can be refunded. Claiming this refund requires filing a detailed application (Form GST RFD-01) with supporting documents demonstrating the complete export turnover and input purchases. Our legal experts help clients prepare such documentation to withstand stringent scrutiny from GST officers.

Legal Services for Navigating Refund Challenges

Different authorities process refunds depending on the refund type. IGST-paid refunds are handled by customs through electronic systems like ICEGATE, while ITC-based refunds fall under jurisdictional GST officers who undertake detailed application verifications. Apex Law Office LLP provides expert representation to interface with these authorities promptly, minimizing delays and ensuring compliance with complex procedural requirements.

Eligibility Criteria for GST Refunds by IT Exporters

IT exporters must fulfill prescribed eligibility norms to claim GST refunds. First, the supply must be classified as an export of service under Section 2(6) of the IGST Act, where the supplier is in India, and the recipient is outside India, with payment received in convertible foreign exchange.

Secondly, exporters should ensure all export supplies are zero-rated, allowing them to claim full ITC on inputs without charging GST on the exports. Other key requirements include:

- Filing valid returns such as GSTR-1 and GSTR-3B on time.

- Maintaining relevant export invoices, Bank Realization Certificate (BRC), and Foreign Inward Remittance Certificate (FIRC).

- Registering a valid LUT or Bond if exporting without IGST payment to avoid tax liability but claim ITC refund.

Apex Law Office LLP assists IT exporters in verifying eligibility practically and advising on document management to avoid rejection or delays due to non-compliance.

Required Documentation for GST Refund Claims by IT Exporters

Successful GST refund claims require precise documentation. IT exporters should maintain:

- Export invoices specifying the service supplied and recipient outside India.

- Shipping bills or bills of export if applicable.

- Valid LUT or Bond documents, where IGST is not paid.

- Bank Realization Certificates or FIRCs confirming receipt of payment in foreign exchange.

- GST return proof, particularly GSTR-1 and GSTR-3B, aligning with export data.

- In cases where refund claims exceed ₹2 lakhs, a certificate from a Chartered Accountant or Cost Accountant certifying the refund amount may be necessary.

Our legal team ensures clients’ documents comply with statutory formats and deadlines, significantly reducing rejection risks and optimizing refund timelines.

Step-by-Step GST Refund Process for IT Exporters

Step 1: Filing Refund Application

IT exporters must file refund claims through the GST portal using Form RFD-01 for ITC refunds or rely on automatic processing via ICEGATE for IGST-paid exports. Apex Law Office LLP advises on accurate data entry to avoid system-generated anomalies.

Step 2: Acknowledgment and Provisional Sanction

The proper officer acknowledges the application within three days (Form GST RFD-02) and may issue a provisional refund sanction (Form GST RFD-04) subject to verification. This phase is crucial, and legal counsel helps exporters respond adequately to any queries.

Step 3: Refund Credit and Verification

90% of the refund is electronically credited promptly, while the remaining 10% is released after thorough scrutiny of supporting documents (Form GST RFD-06) verifies refund legitimacy. Our legal experts facilitate document verification protocols to expedite release.

Step 4: Handling Discrepancies and Rejections

If any inconsistencies arise, the GST officer may seek additional information, leading to possible delays. Apex Law Office LLP offers representation and legal advice for appeals and rectification processes to safeguard exporters’ interests.

Importance of Legal Services in Maximizing GST Refunds for IT Exporters

Navigating GST refunds requires comprehensive legal knowledge and procedural expertise. Apex Law Office LLP’s GST lawyers specialize in interpreting statutes, representing clients before authorities, and ensuring that every claim aspect — from eligibility to refund receipt — aligns with law and policy.

Our legal services enable IT exporters to:

- Optimize refund claims through accurate classification of supplies and input credits.

- Manage complex documentation and filing timelines rigorously.

- Represent clients effectively during audits or disputes over GST refund claims.

- Minimize working capital blockage by fast-tracking refund approvals.

IT exporters benefit immensely when legal professionals mitigate risks associated with GST refund procedural errors, thus securing maximum rightful refunds and ensuring business continuity.

Case Laws and Legal Precedents Impacting GST Refunds for IT Exporters

Judicial pronouncements have shaped GST refund interpretations, especially concerning service exports. For instance, courts have upheld exporters’ rights to claim ITC refunds on zero-rated supplies even without IGST payment, reinforcing exporter protections under GST laws.

Apex Law Office LLP keeps abreast of evolving case laws, helping clients align refund claims with judicial expectations and regulatory clarifications, thus avoiding common pitfalls in GST refund processes.

Conclusion: Leveraging Apex Law Office LLP for Expert GST Refund Solutions

In the dynamic and competitive IT export sector, maximizing GST refunds can significantly enhance your firm’s cash flow and profitability. Apex Law Office LLP offers dedicated legal consultancy and litigation support to ensure your refund claims meet all statutory requirements, are accurately filed, and promptly processed.

Trust our experienced team of GST lawyers for comprehensive legal assistance ranging from advisory to dispute resolution, tailored specifically for IT exporters. By partnering with Apex Law Office LLP, you can confidently navigate India’s GST refund mechanisms and optimize your export business returns.

Contact Apex Law Office LLP today for specialized GST refund legal services and enable your IT export business to unlock its full financial potential.

Read More

- Termination Clauses in Tech Contracts: What Founders Must Know

- Can You Patent Software in India? The Truth About Tech Patents

- Milestones-Bugs and Blowups: Contract Clauses That Kill IT Projects

- UI/UX Design Copycats: How to Protect Your Software’s Look and Feel

Who Owns the Code? Source Code Ownership Disputes in IT Companies