In the realm of legal matters, dealing with cheque bounce cases requires precision and expertise. Appellate Lawyers Office stands as the go-to choice, recognized as the best senior attorney firm, offering unparalleled legal support for navigating the complexities of cheque dishonur cases.

CHEQUE BOUNCE CASE LAWYERS in Chennai

1. Expertise Tailored to Cheque Bounce Cases:

- Rely on legal services specifically crafted for cheque dishonur cases, ensuring a nuanced approach to legal complexities.

- Appellate Lawyers Office boasts a team of seasoned attorneys with expertise in cheque bounce cases, providing clients with confidence and clarity.

2. Unparalleled Legal Support:

- Benefit from a comprehensive legal approach tailored to your unique situation.

- Appellate Lawyers Office is committed to delivering unparalleled legal support, ensuring a strategic and empathetic representation for individuals dealing with cheque bounce cases.

3. Transparent Communication with the Best Advocates:

- Connect directly with the best advocates specializing in cheque bounce cases.

- Appellate Lawyers Office prioritizes transparent communication, ensuring clients are well-informed at every step of their legal journey, providing them with the peace of mind they deserve.

For those grappling with cheque bounce cases, Appellate Lawyers Office offers more than legal expertise—it provides a caring and informative partnership to navigate the legal landscape with confidence. Contact us to secure the best advocates dedicated to resolving cheque dishonur cases with efficiency and compassion.

Who is the best Advocate for Cheque bounce cases in Chennai ?.

Introduction : What do you mean by cheque bounce case ?. Did your debtor dishonored or bounced the Cheque ?. In any case, Did you receive any cheque bounce notice?. Did you receive court summons under Negotiable Instruments Act?. If yes, contact Cheque bounce case lawyers in Saravvanan & Sathish Advocates Law firm. Of course, are the right legal professionals. In fact, They can only help you resolve the issue.

What is Cheque?

A Cheque is all in all a bill of exchange that directs a bank to pay a certain amount from a person’s account to the person on whom the cheque is drawn.

The cheque is a type of bill of exchange that makes one’s life easy for all of us. No doubt, A Cheque eliminates the fear of getting robbed during any journey

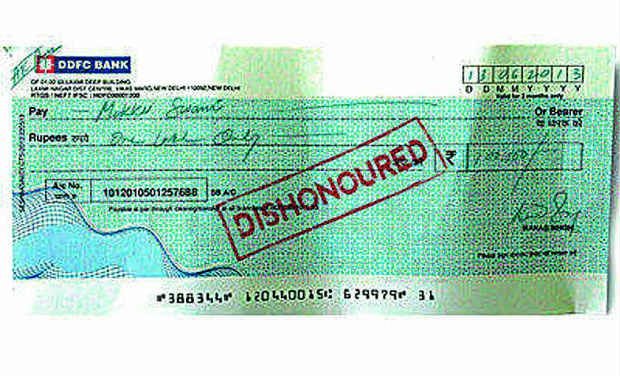

What is Cheque bounce or dishonor?

The Dishonor or bounce of cheque is indeed a term when the banker is unable to deposit it. By the way, there are many reasons for this issue. Furthermore, Find below are the general reasons for cheque dishonur.

The difference in the word and figures mentioned on the cheque.

- When you cross the cheque

- Overwriting on cheque

- Account closed

- Deposition of the cheque after its expiry

- Opening balance insufficient

- If a company issues the cheque a company, the company seal missing

- Mismatch in the account number

- Death of the customer

- Insolvency and insanity of the customer

- If only one of the joint account holders have signed the cheque

- Doubt in the authenticity of the cheque

- Presented at the wrong branch

- Alteration in the cheque

Cheque bounce is a criminal offense without a doubt. On the other hand, As per the Indian law there is a punishment of imprisonment up to 2 years for such offense. At any rate, It may be With monetary penalty or with both punishments is applicable for this offense.

Our expert team of Cheque bounce lawyers will be able to guide through the process of such litigation.

When is Cheque bounce an offense?

The offense of dishonor of cheque is nothing but the following :

- The cheque is issued for discharge of any debt or liability

- A cheque is presented within its validity period

- The Payee issues notice to the drawer within 30 days of return of the cheque

- After such notice, the drawer fails to pay the cheque within 15 days of receipt of such notice

How our team of Cheque bounce case lawyers handles your case ?.

The following steps explain how we handle your case:

Step 1: Demand Notice for Dishonor of Cheques

During Cheque bounce you must send a demand notice or legal notice to the drawer within 30 days of such bouncing. The demand notice contains a warning to initiate proceedings under the Negotiable instruments Act in case of failure to make the amount within 15 days. Our team of Cheque dishonur case lawyers will help you in drafting demand notice.

Step 2: Drafting of Complaint for Dishonor of Cheques

If you don’t receive the payment within 15 days from the date of delivery of the demand letter, you must file a complaint with the magistrate against the payer within 30 days. Our team of Cheque bounce lawyers will help you in drafting a complaint

Step 3: Court Process for filing a Cheque bounce case

- An amount is charged by the court as a fee depending on the cheque amount.

- At the time of filing a case, You need Memo of Advocate along with signatures of the complainant.

- After the complainant files a case in court, the Judicial Magistrate First Class will cross-check all documents. The documents are original bounced cheque, notice copy, original memo, Postal receipt, acknowledgment receipt, and receipt of U.P.C.

- Verification of the limitation period at this stage.

- The Complainant or lawyer will file the Process Form or Bhatta along with the address of the accused.

- A court summons is issued to the accused to appear in court on a specific date.

- If the accused fails to appear in court on the hearing date, the court issues a bailable warrant on the request of the complainant.

- If the accused still disobeys the court and does not appear, the court may issue a non-bailable warrant of arrest.

Read More

- Corporate lawyer

- Company Litigation Lawyers: The Best Legal Help in Chennai

- Human Rights Violation: Call the best criminal attorney

- Supreme court issues notice on the plea upon anti-religious law

- Copyright: How to find the Best Authentic IP Attorney?

Some Important points in Cheque bounce Cases

- The party must file the cheque bounce case in the area where the cheque has been submitted by you.

- Usually, the payee files case. But, a power of attorney can also file a case under special scenarios

- At this point, The complainant has to mandatorily appear before the magistrate and take the oath.

- At any rate, When the bank mentions material alteration in a cheque, then the person is not eligible to file a Dishonored Check case.

- In addition, there are various other ways through which a Returned Check case you can deal with. Meanwhile you can file a criminal complaint of cheating. If you want to file a cheque bounce case against your company or firm, you need to file a complaint against the directors or partners or company

Contact and Discuss your queries with Our Expert Cheque Bounce Case Lawyers!